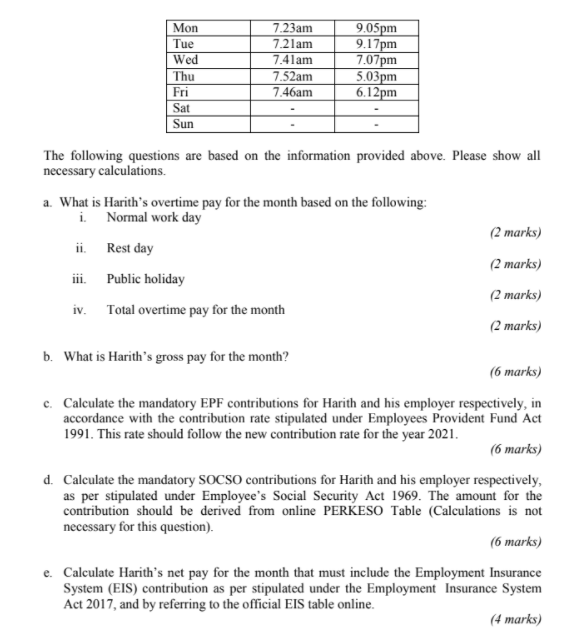

The law on overtime. This means an average of about 4.

RM 5500 x 11 refer Third Schedule.

. The protection under the Employment Act only applies to these categories of employees lets call them EA Employees. In excess of eight 8 hours-20 x. RM 5500x 12 calculation by percentage.

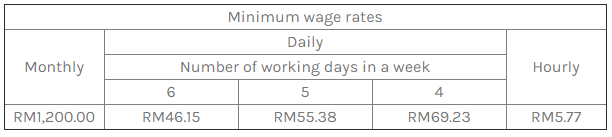

Of course overtime work has a limit. RM1200 per month 26 days RM577 per hour X 2 RM5769 per day. RM100 8 hours RM1250.

05 x ordinary rate of pay half-days pay ii. Employee work 10 hours on rest day. As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times hisher hourly rate for overtime work in excess of the normal work hours.

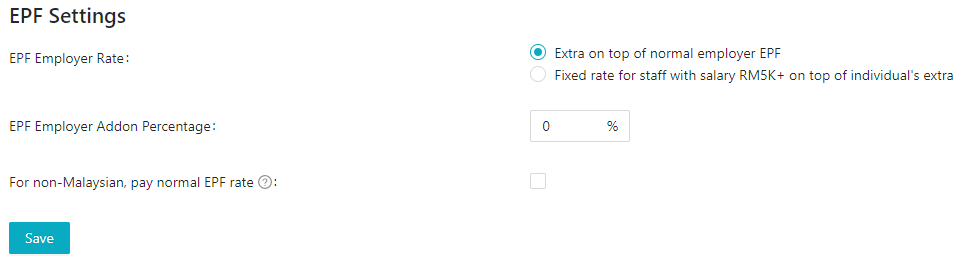

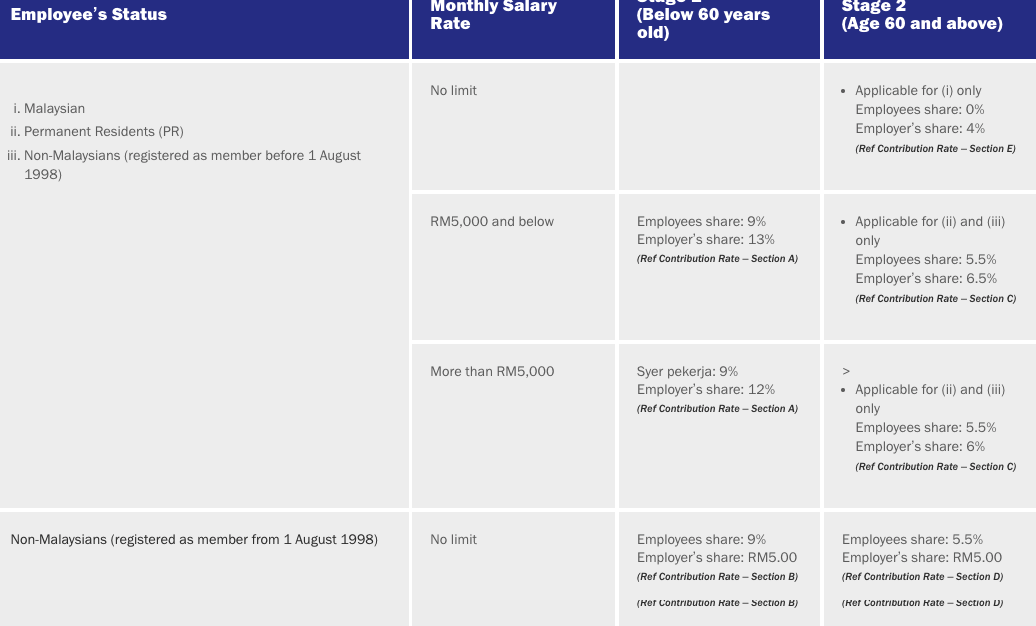

EPF Employer Contribution. The Employment Limitation of Overtime Work Regulations 1980 provides that the limit of overtime work shall be a total of 104 hours in any 1 month. Then The Unpaid Leave Deduction Per Day 10000 22 4545454.

Career Resources - Overtime is part of work life. For employees with salary not exceeding RM2000 a month or those falling within the First Schedule of Employment Act 1955 the laws in respect are spelled out in the. However employers are also allowed to choose any other calculation.

For any overtime work carried out in excess of the normal hours of work EA Employees are to be paid at a rate not less than 15 times hisher hourly rate of pay HRP. Normal working day 15 Basic pay 26 days X 15 X hour of works. Working in excess of normal working hours on a normal work day.

The Employment Limitation of Overtime Work Regulations 1980 grants that the limit of overtime work shall be a total of 104 hours in. The salary range for people working in malaysia is typically from 175800 myr minimum salary to. RM50 8 hours RM625.

How OT hours are calculated based on Seksyen 60 3 Seksyen 60 1 Employment Act 1955. For employees paid on a monthly basis overtime entitlements under the Employment Act are as follows. In Malaysia the Employment Act 1955 defines overtime as the number of hours of work done beyond the normal working hours.

Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then multiply that figure with the number of overtime hours worked. Employees whose monthly salary does not exceed. More than half but up to eight 8 hours of work-10 x ordinary rate of pay one days pay iii.

The Employment Act provides that the minimum daily rate of pay for overtime calculations should be. This calculated according to the following formula. Ordinary rate of pay per day Normal working hours per day.

Divide the employees daily salary by the number of normal working hours per day. For holiday you should pay employee at rate 20 X for. Here this would be RM625 x 15 x 2 hours RM1875.

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Calculation Dna Hr Capital Sdn Bhd

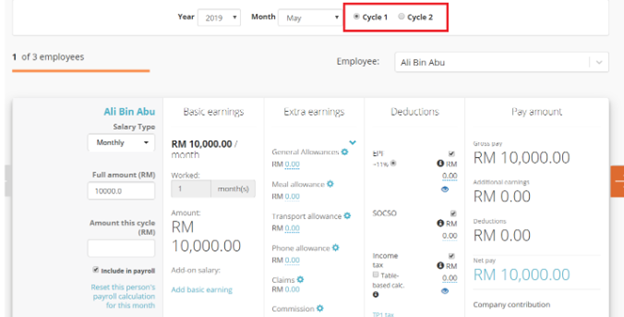

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Easy Steps On Calculating Your Overtime Pay Free Downloadable Sheet Career Resources

Employment Law New Minimum Wage Rates To Take Effect On 1 February 2020 Lexology

Your Step By Step Correct Guide To Calculating Overtime Pay

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Payroll Malaysia Overtime And Public Holiday Maybank Cimb Pbb Payslip Singapore And Malaysia Youtube

Overtime Calculator For Payroll Malaysia Smart Touch Technology

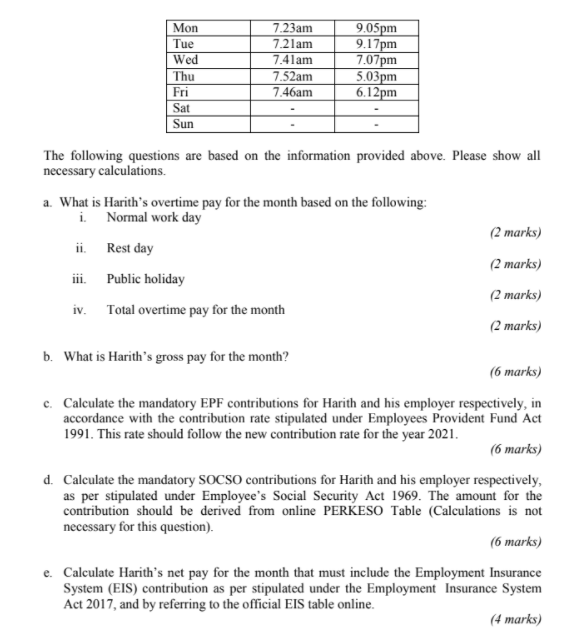

Solved While Waiting For His Sijil Pelajaran Malaysia Spm Chegg Com

Best Solution For Calculate Overtime And Allowance For Payroll Malaysia

Overtime Calculator For Payroll Malaysia Smart Touch Technology

How To Calculate Overtime For Salary Employees In Malaysia Madalynngwf

Overtime Calculator For Payroll Malaysia Smart Touch Technology

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Your Step By Step Correct Guide To Calculating Overtime Pay

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog